Finance Norway - Interview with Arne Hyttnes

February 8, 2011

administrator

During the 1990s banking crisis in Norway, Arne Hyttnes worked as a regional corporate lending director for Den norske Bank (now DnB NOR). Nearly two decades later, he is the leader of all of the country’s financial services and saving bank associations under the newly combined Finance Norway. In an interview with Norway Exports six weeks into his new job, Hyttnes discusses the rationale behind the merger, why Norwegian banks weathered the financial crisis so well, and future challenges facing the industry.

Hyttnes took over as managing director of Finance Norway (FNO) on January 1, 2010. FNO was created from the combination of the Norwegian Savings Bank Association – which he still heads – and the Norwegian Financial Services Association. Altogether, the FNO represents some 180 financial institutions operating in the Norwegian market within different sectors, including savings banks, commercial banks, life insurance companies, non-life insurance companies, finance companies, management companies for securities funds, investment firms and finance conglomerates.

Although the decision was taken in the second half of 2009, the actual trigger for the combination came from a meeting in March 2008 with DnB NOR, Norway’s largest bank and the biggest member in both organizations, said Hyttnes. DnB wanted a new organization because it felt ultimately it would have to choose between the two. The two associations decided to start the process because they felt there were many common interests between the banks, potential costs savings, and a need to build an organization with necessary specialists within areas such as EU regulation and Basel II, the recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision.

“The world has become more complicated over the past 10 years,” said Hyttnes. “You have to have specialists on many fields. To have critical mass, it was necessary to join forces.”

© Finance Norway

Bank Stimulus Packages

Finance Norway works mainly by helping influence rules before decisions are taken in Brussels through its membership in the European Savings Banking Group and the European Banking Federation. At home, it works on having these EU directives implemented so as to create a level playing field, as well as working with the Government and financial authorities on creating a sound Norwegian financial industry.

Perhaps one of its most visible efforts recently was its hefty dialogue with the Norwegian Government in the past 12 months on putting together two stimulus packages to help banks get access to funding in the wake of the global credit crunch. As a result, the Norwegian finance ministry announced in October 2008 it would allow banks to swap their covered bonds with government bonds and use that to borrow money in the market. In February 2009, the Government created the NOK 50 billion State Finance Fund. Norwegian banks, mostly the larger ones, drew NOK 220 billion out of the first bank package. But banks only availed themselves to NOK 4.1 billion out of the second package because the market later improved and banks were able to get funding in the market.

“It was very important that the packages could be suitable to cover objectives they should cover,” said Hyttnes. “That’s a good example of the way we try to work.”

Conservative Banks

Norway was relatively unscathed by the global financial crisis. The Government had an ample budget surplus to draw on to pay for the emergency bank packages. There were no bank failures and no increase in government ownership in the banks. In fact, the government ended up turning a profit on both schemes, said Hyttnes.

Part of the reason for Norway’s good fortune is its conservative banking culture. DnB NOR, for example, avoided incurring high risk in global investments, such as sub-prime and Lehman Brothers. The industry’s only notable glitch in this respect was Terra Securities, which sold sub-prime products to a number of communities in northern Norway. However, its parent group Terra,

owned by 78 small savings banks, remained afloat.

“We had a major banking crisis in the 1990s,” said Hyttnes. “I worked at DnB at the time, so I know the history. Shareholders lost their value. The bank was in reality taken over by the authoritiesfor a short time. I think Norwegian banks learned a lesson from that. I think the Norwegian banking industry is very conservative, so it’s not by luck that we were not hit by this.”

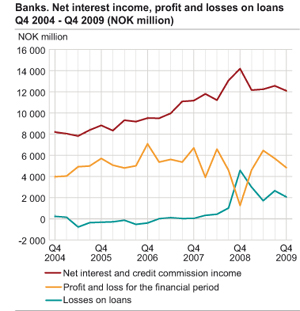

In 2009, Norwegian bank profits increased NOK 5.2 billion to NOK 21.6 billion compared to 2008, according to Statistics Norway. The net interest income was high all through 2009 and contributed positively to the result together with increasing gains on securities and currency. Norwegian finance companies delivered the strongest results ever of NOK 2.1 billion on the back of strong net interest income, which reached an unprecedented NOK 7.4 billion at the end of 2009.

In the future, Finance Norway will be focused on the expected tsunami of new EU regulations in the banking sector as a result of the financial crisis. The Financial Supervisory Authority of Norway recently sent a letter to the finance ministry in which it discussed whether new regulations on liquidity should be incorporated while waiting for these new rules. Hyttnes expects that there will be stronger qualitative and quantitative requirements for liquidity, as well as the Capital Requirements Directive related to gearing.

“You have to have much more equity today than you did two years ago,” said Hyttnes. “Most Norwegian banks are increasing their equity base. There is no formal regulation so far… we see this coming.”

Related Posts

YOUR GATEWAY TO THE NORWEGIAN EXPORT MARKET

Search Norway’s largest database of exporters:

• 35 business sectors

• 2000 product groups

• 8000 products & services

• Companies, trademarks, products or services