DnB NOR's conservatism & international ambitions

November 6, 2010

administrator

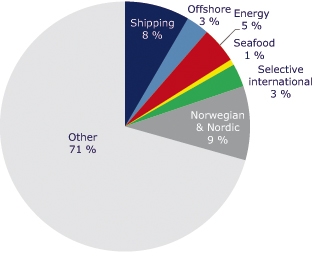

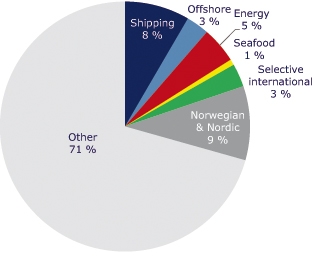

The Norwegian banking industry has been praised by the OECD for its conservative culture and stability in the wake of the financial crisis. Nowhere has this been more evident than with DnB NOR, Norway’s leading financial services institution. Not only did it not need to avail itself of government assistance via the Norwegian State Finance Fund, it emerged strengthened and continued to expand internationally in its core areas: shipping and offshore, energy, and seafood.

In 2008, markets in the US were reeling from the collapse of Lehman Brothers and a global credit squeeze. The financial crisis was affecting Europe and the Norwegian government was concerned. Even though Norwegian banks were financially sound, the markets for lending had frozen up, affecting the banks’ ability to do business as usual.

© DnB NOR

Conservative Culture

Despite the recession, DnB NOR was successfully able to raise share capital in the market because of its sound financial standing. The bank did not have large exposure to toxic assets, such as Lehman Brothers or subprime mortgages, which rocked other large international financial institutions.

The company follows a conservative stance with a high quality customer portfolio. Norway’s Financial Services Association believes Norway’s conservative banking culture is partly a consequence of the lessons learned from the Norwegian banking crisis in the 1990s when the Government essentially nationalized DnB.

“Among other things, (Norwegian banks) have avoided incurring high risk in relation to global capital markets,” said Arne Skauge, Norwegian Financial Services Association Managing Director, in its 2009 report. “Nor can we exclude the possibility that experience drawn from the banking crisis in the early 1990s has made a positive contribution, both to the operation of banks and to the regulation and supervision of our financial markets.”

DnB NOR has emerged strengthened from the crisis and continues to expand abroad. In 2009, DnB NOR’s international units, excluding DNB NORD, increased its share of group income from 7.4% in 2007 to 11.1%. Investment banking has been a strong contributor to its international growth. The company added capabilities internationally during 2008-2010 in the US, Europe and Asia.

In New York and Houston, it added commodities, equity sales, debt capital markets, corporate finance (Houston), fixed income sales, and treasury. In London, it added commodities and equity sales and in Stockholm commodities, fixed income sales, investment products, debt capital markets and securities services. Singapore and Shanghai now both have commodities, but there is also equity sales and research, corporate finance and fixed income sales in Singapore.

Energy, Shipping, Seafood Focus

The group’s focus areas are shipping and offshore, energy, and seafood, with selective international positions in telecom, health care products, forestry industry, and media. The most prominent growth area is offshore, which will grow with the need for finding new oil reserves. Here, the group has combined corporate banking with investment banking to increase its value added for its clients.

© DnB NOR

The group plays a leading role within shipping internationally. The group ranked second in syndicated loans in 2009 with USD2.327 trillion in deal value after Mitsubishi UFJ Financial Group, and ahead of ING and Sumitomo Mitsu Banking Corp, according to Dealogic. It was awarded the Marine Money 2009 Deal of the Year Award in the category Public Debt Europe for its work with Norwegian company Bonheur.

However, the group expects energy will be the most important growth area over the next two to three years. DnB NOR aims to be a leading global energy bank within selected segments. It has a low risk and well-diversified portfolio including oil and gas, hydropower and utilities, offshore contractors and oil field services, and other renewables.

Its energy experts serve customers globally through DnB NOR Energy Finance offices in Houston, London, Oslo, Stavanger, Stockholm and Singapore. In the US, it placed number one on US Investment Grade Energy Lead Arranger FY 2009 for seven deals totalling USD3.9 trillion, beating JP Morgan and Bank of America Merrill Lynch, according to Leif Teksum, DnB NOR group Executive Vice President.

Seafood is relatively smaller area for DnB NOR, but it has a significant market share. DnB NOR Seafood saw its pre-tax operating profit before write-downs rise from NOK 199 million in 2008 to NOK 246 million in 2009.

Related Posts

YOUR GATEWAY TO THE NORWEGIAN EXPORT MARKET

Search Norway’s largest database of exporters:

• 35 business sectors

• 2000 product groups

• 8000 products & services

• Companies, trademarks, products or services