East meets West in Singapore - Oslo dual listing pact

May 5, 2010

administrator

Oslo Børs reached an agreement last July with Singapore Exchange Limited (SGX) that will allow for secondary listings on each other’s exchanges. The initial targets are companies within their common energy, offshore and shipping sectors, where the two exchanges have a strong concentration of listed companies. The first to take advantage have been a Norwegian shipping company and a Chinese fisheries group.

In March, the two exchanges approved the first companies for dual listing: dry bulk carrier Golden Ocean and China Fishery Group, an industrial fishing company listed on SGX. The collaboration will accelerate the listing process and reduce the regulatory burden of being listed on two exchanges, giving companies the benefits of share trading in two time zones and access to a more diverse and large pool of investors.

“We are pleased that the collaboration between SGX and Oslo Børs is showing fruition,” said Lawrence Wong, SGX Executive Vice President and Head of Listings. “This will also boost the sector strengths and diversity of companies listed on both exchanges.”

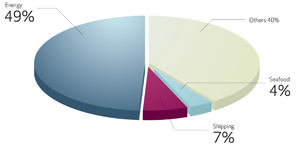

Oslo Børs’ largest sector is energy, which accounts for 49% of market capitalization of its listed companies. Oslo Børs’ energy sector is the second largest in Europe by number of listed companies and has the second largest in the world within oil service and drilling.

In shipping, Oslo Børs is Europe’s largest ranked by number of listed companies and the third largest in the world. There are 25 listed companies accounting for 7% of market capitalisation on Oslo Børs and 29 companies listed on SGX operating in the maritime and offshore sector.

Shipping Sails East

Golden Ocean Group, controlled by John Fredriksen, was the first Norwegian listed company to announce plans to seek a secondary listing in Singapore as a result of this agreement. The company completed its secondary listing on SGX on March 18 via an introductory listing, without raising share capital.

“We are going early here,” said Geir Karlsen, Golden Ocean Chief Financial Officer. “Fredriksen was early listing (Frontline) in the US. We’re doing the same thing in the Far East. There are very few western shipping companies listed in the Far East.”

As a result, investors in Singapore can now purchase shares in Golden Ocean in Oslo and chose to have the shares moved to the Singapore exchange or keep them in Oslo. This will widen the company’s investor base by removing the hurdle for some Asian investors.

“One thing we can achieve by doing this is to get huge institutional investors,” said Karlsen. “Many companies are approaching our advisors and say they want Golden Ocean shares but don’t have the authority to buy outside Singapore.”

The company briefly considered an over-the-counter (OTC) listing in the US last year, but opted to seek a secondary listing in the Far East because of Golden Ocean’s strong business connection there, said Karlsen. The company has an office in Singapore and the majority of its revenues generated in Asia, mostly from China.

The company mulled both Singapore and its larger rival Hong Kong. But in the end, it chose Singapore because of the large percentage of shipping companies listed there and the strong Norwegian banking and ship broking presence. Moreover, with the new dual listing agreement in place, it was much simpler to seek a secondary listing in Singapore because the disclosure requirements are the same.

“To do the Hong Kong listing would have been a bit more complicated and time consuming,” said Karlsen.

BW Offshore, one of the world’s leading FPSO contractors and a leader within advanced offshore loading and production systems to the oil and gas industry, in February became the second Norwegian company to announce plans for a secondary listing in Singapore. The company has an operating presence in Singapore.

Fish Go West

Prior to that, China Fishery Group will be the next to list as a result of this deal. The Hong Kong based company plans to carry out an offering of new shares in connection with the proposed secondary listing on Oslo Børs, scheduled to take place in 2010. The company is a global integrated industrial fishing company with access to fish in some of the world’s most important fishing grounds. It operates over 60 vessels in the Pacific Ocean.

Its planned listing confirms the attractiveness of Oslo Børs as the world’s leading seafood exchange in market capitalization and number of listed companies. There are 14 listed seafood companies accounting for 4% of total market capitalisation of all listed companies on Oslo Børs, such as Marine Harvest, the largest producer of farmed salmon.

China Fishery said there are many benefits for the company, as well as its shareholders, from having a dual listing on two recognised exchanges. The listing will enable China Fishery Group to raise its company profile in Norway and Europe, where many of its customers and business partners are located. A dual listing will also increase its visibility and shareholder base, enabling it to better attract European institutional investors, as well as allowing China Fishery’s shares to trade in two different time zones.

“Oslo Børs is a well recognised stock exchange and is the leading place for companies in the fishing and seafood industries to list,” said Ng Joo Siang, China Fishery group Managing Director. “Through our listing on the Oslo Børs, we will be able to tap into a pool of potential investors who know and appreciate the industry we are in.”

“We believe that this will lead to improved liquidity in the trading of shares in China Fishery, and potentially an increase in existing shareholder value.”

© Oslo Børs

Related Posts

YOUR GATEWAY TO THE NORWEGIAN EXPORT MARKET

Search Norway’s largest database of exporters:

• 35 business sectors

• 2000 product groups

• 8000 products & services

• Companies, trademarks, products or services